Income Tax Brackets 2025 Usa. The 15% rate, for example, applies for single. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350.

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Follow ap’s live coverage of the investigation into the assassination attempt on trump, the rnc and more democrats.

2025 Tax Brackets Irs Chart Vivia Linnie, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. How do current federal individual income tax rates and brackets compare historically?

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married. Based on your annual taxable income and filing status, your tax.

2025 Tax Brackets Chart By State Adora Patrica, New income thresholds are in effect for 2025 and 2025 tax brackets. When you are looking at the federal tax brackets, you are able to determine which tax rate applies to you for the current tax.

Irs Tax Brackets 2025 Single Phaedra, Your taxable income and filing status determine both the tax rate and bracket that apply to you, outlining the amount you'll owe on different portions of your income. And is based on the tax brackets of.

2025 Tax Brackets Vs 2025 Tax Tables Irina Angelica, Under the new tax regime, taxpayers with a net taxable income of up to rs 7,00,000 are eligible for a. The federal income tax has seven tax rates in 2025:

Us Tax Brackets 2025 Married Jointly Tax Brackets Ebonee Collete, The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for tax. But the staff report specifies that this shift should come in late 2025, to avoid more upside surprises in inflation data, without specifying a particular month.

Tax Brackets For 2025 Vs 2025 Taxes Nita Valina, How do current federal individual income tax rates and brackets compare historically? In the u.s., there are seven federal tax brackets.

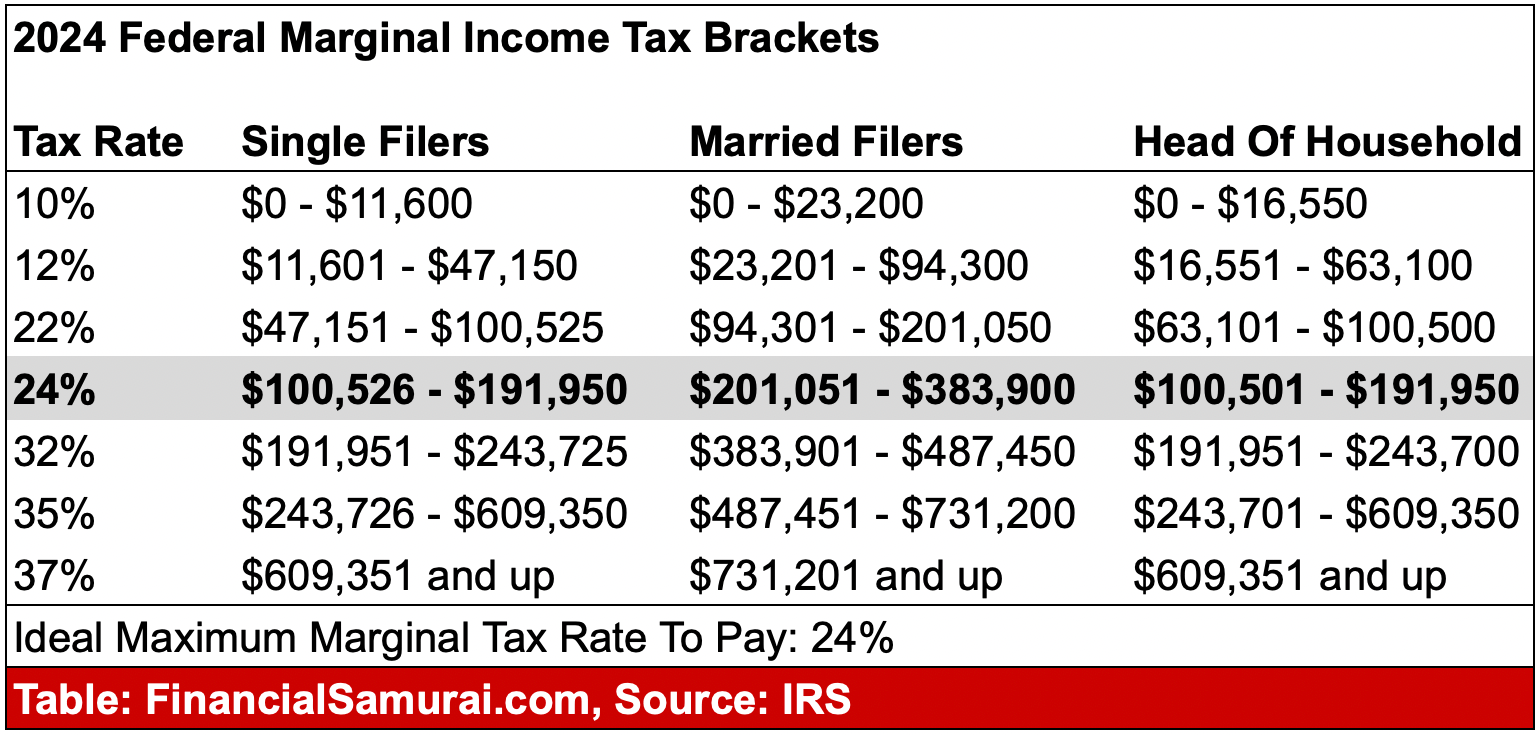

2025 Tax Brackets And The New Ideal Money Wiseup, Local rates are weighted by population to compute an average. If you’re one of the lucky few to earn enough to fall into the 37% bracket, that doesn’t.

State Corporate Tax Rates and Brackets, 2025 Taxes Alert, For tax year 2025, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%. How to calculate federal tax based on your annual income.

2025 State Tax Rates and Brackets, If you’re one of the lucky few to earn enough to fall into the 37% bracket, that doesn’t. It is mainly intended for residents of the u.s.

The irs increased the income threshold for each of its tax brackets by about 5.4% for each type of tax filer for 2025.