Md Estimated Tax Payments 2025. The online service accepts payments for individual income tax, business sales and use tax, and business withholding taxes 24 hours a day, seven days a week and applies to taxes owed for the current year or any previous year. Tax return, extension, or tax estimated form).

Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or transfer. How to use the maryland paycheck calculator.

State Of Maryland Estimated Tax Payments 2025 ashly lizbeth, When paying estimated taxes, you.

Maryland Estimated Tax Payment Due Dates 2025 Babara Tarrah, You can make an estimated payment tax payment on line by direct debit or credit card payments.

Maryland Estimated Tax Payments 2025 Forms Kelcy Melinde, Use our income tax calculator to find out what your take home pay will be in maryland for the tax year.

20202024 MD Form 129 Fill Online, Printable, Fillable, Blank pdfFiller, Estimated nonresident tax calculator for 2025.

Q1 Estimated Tax Payment Deadline 2025 Callie Valenka, The free online 2025 income tax calculator for maryland.

Estimated Tax Payment Dates 2025 Schedule Debora Carmine, The online ifile application is supporting tax years 2025, 2025, 2025 and estimated payments for tax year 2025.

2025 Tax Rates And Deductions Available Tessi Gerianne, Enter your details to estimate your salary after tax.

Estimated Tax Payments 2025 Forms Vouchers Chere Verile, The online ifile application is supporting tax years 2025, 2025, 2025 and estimated payments for tax year 2025.

How Do I Calculate My Estimated Taxes For 2025 Hanny Kirstin, The online service accepts payments for individual income tax, business sales and use tax, and business withholding taxes 24 hours a day, seven days a week and applies to taxes owed for the current year or any previous year.

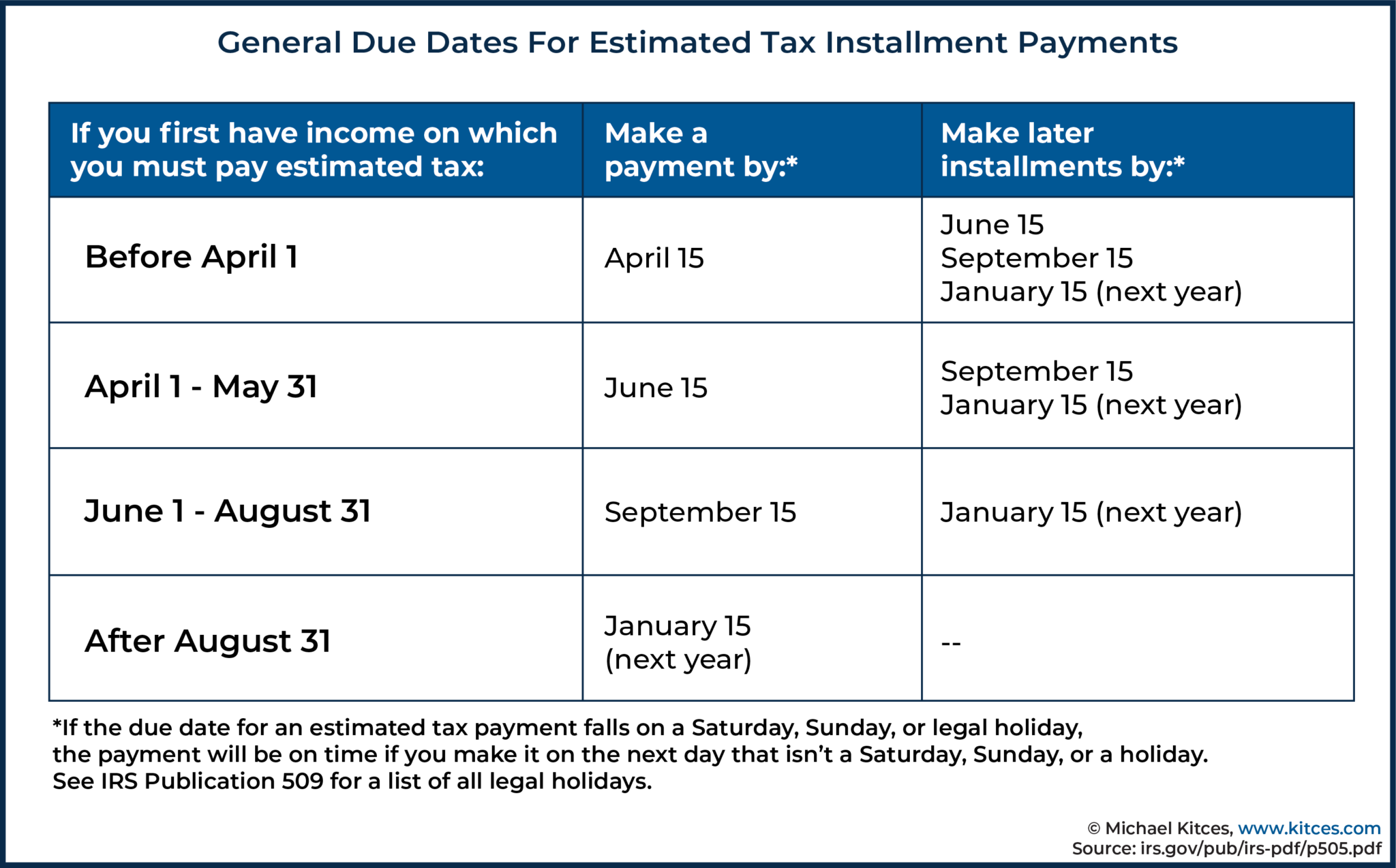

Estimated Tax Payments 2025 Maryland Dorthy Lucinda, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.