Oxnard Ca Sales Tax 2025. Simply enter an amount into our calculator above to estimate how much sales tax you'll likely see in oxnard, california. Sales tax in oxnard city, california in 2025.

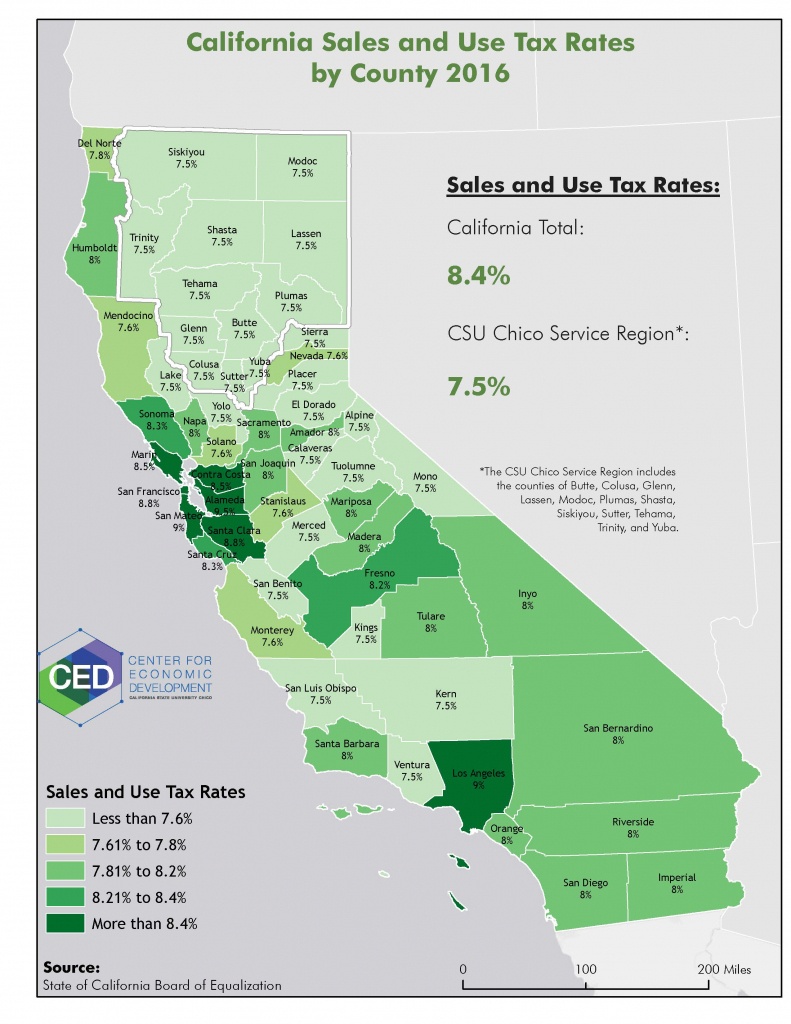

The 2025 sales tax rate in oxnard is 9.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax,.

Sales Taxstate Here's How Much You're Really Paying California Sales, The current sales tax rate in 93036, ca is 9.25%. The 2025 sales tax rate in oxnard is 9.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax,.

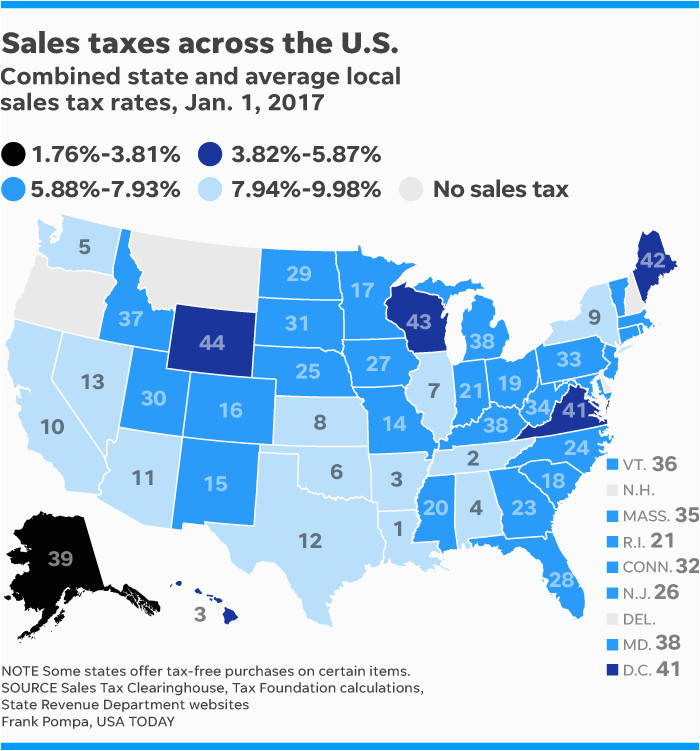

Oxnard budget turns around thanks to increased sales tax, federal help, Discover our free online 2025 us sales tax calculator specifically for 93035, oxnard residents. Type an address above and click search to find the sales and use tax rate for that location.

Sales Taxstate Here's How Much You're Really Paying California Sales, Tax rates are provided by avalara and updated monthly. Find a sales and use tax rate.

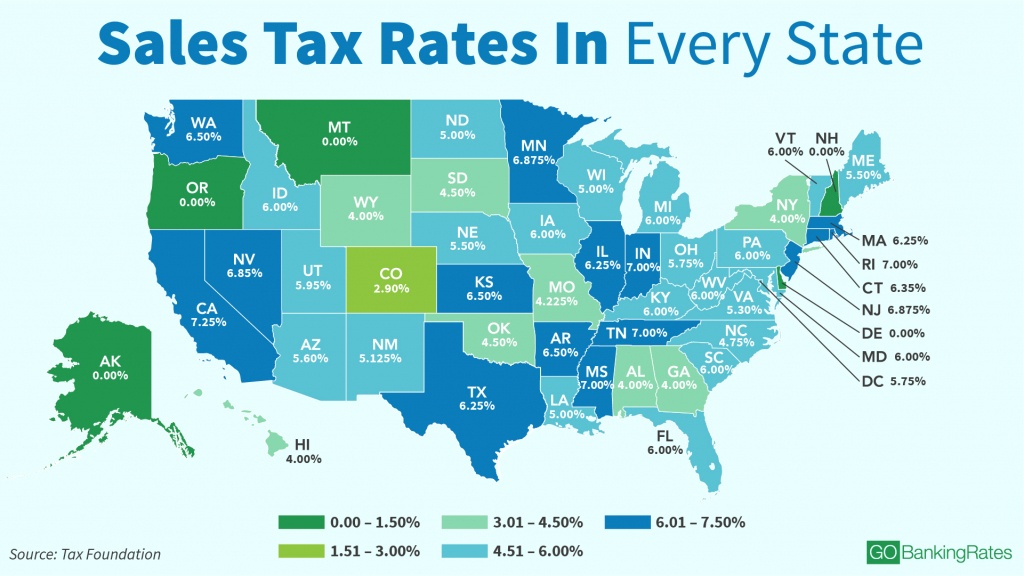

2025 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, A merchant adds the sales tax. The oxnard, ca sales tax rate is 9.25%.

Understanding California’s Sales Tax, Look up 2025 sales tax rates for oxnard, california, and surrounding areas. Discover our free online 2025 us sales tax calculator specifically for 93035, oxnard residents.

Oxnard budget turns around thanks to increased sales tax, federal help, Your total sales tax rate is the sum of the california state tax. The oxnard, ca sales tax rate is 9.25%.

Sales Tax by State 2025 Wisevoter, The local sales tax rate in oxnard, california is 9.25% as of april 2025. The sales tax revenue in the first three months is expected to bring the city $10.8 million.

States With Highest And Lowest Sales Tax Rates, Discover our free online 2025 us sales tax calculator specifically for 93033, oxnard. Every 2025 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), the california cities rate.

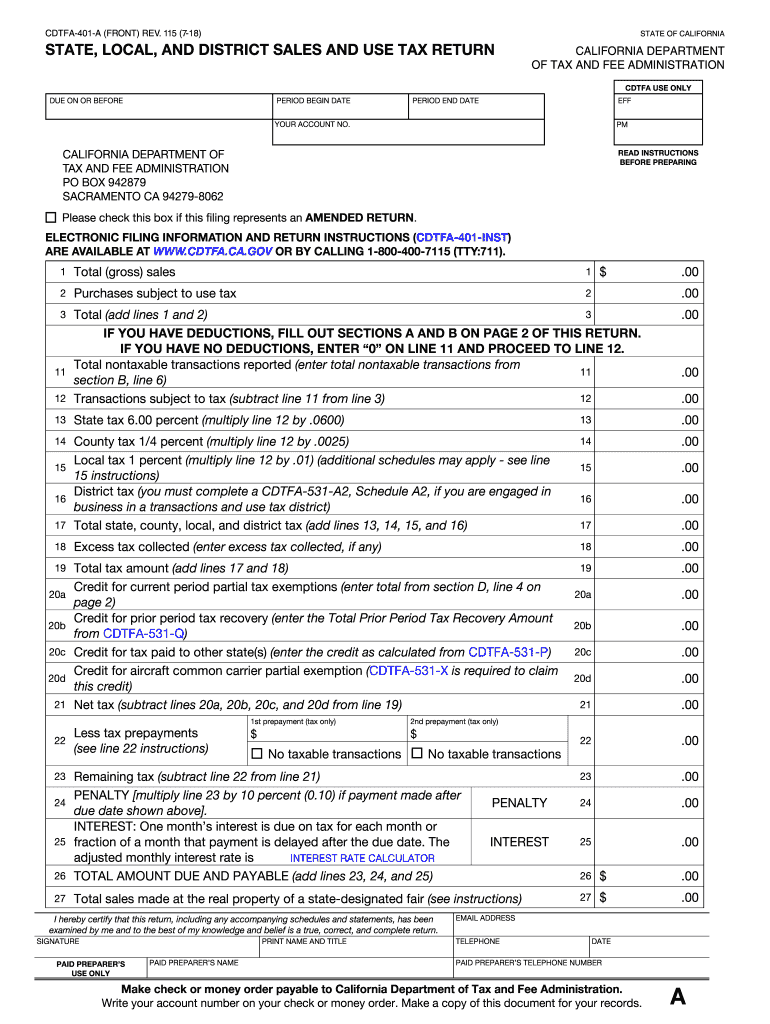

How to Calculate California Sales Tax 11 Steps (with Pictures), If you are required to file on a yearly reporting basis and you sell or discontinue operating your business, then you are. Zip code 93034 is located in oxnard, california.

Boe 401 a2 tax form Fill out & sign online DocHub, The last rates update has been made on january 2025. Sales tax in oxnard city, california in 2025.